Your FICO Score is a service provided to the credit bureaus or “Fair Issac Corporation” Score. It uses information from your credit file to assist banks and lenders to determine how credit worthy you are. The score they give you is supposed to determine your risk of default to a bank or lender.

You actually have three FICO scores, one for each Credit Bureau:

- Transunion

- Equifax

- Experian

Each of these scores use the same composition, yet the score itself can be very different. The reason is that each bureau has its own database of information to pull from resulting in different scores.

So it’s possible that TransUnion knows you were late on your car payment BUT Equifax doesn’t know it yet. Or maybe you have a collection account that shows with Experian but not Transunion.

See? Absolutely clear as mud right? On top of it all, not all lenders look at the same score to “rate” you. A mortgage company may only look at TransUnion where if you are buying a car, that lender may only look at Experian.

Let’s look at your score itself, it will range from 300 – 850 and this is the breakdown:

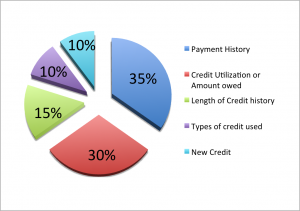

Now to determine your score, they ONLY look at information in your credit file. Your score is based on these FIVE categories only. One category may be more important to one person than another, depending on their personal credit file. As the information in your credit report evolves, so does your score.

Example:

You have had a few credit cards for over 10 years (15% of score) BUT you don’t pay on time (35% Payment history). That calculation of your score will be very different compared to the flip side of that coin. If you have had a few credit cards for less than 5 years (15% of your score) but you always pay on time. (35% payment history), your score could look very different from the first example.

It always comes down to one thing though – 35% of your score is based on your Payment History. What’s the single most important thing about your score? Pay your bills on time. Sure, it’s a variety of factors that add up to one score – Don’t you think it’s fair to say that paying your bills on time is the most important though?

~V

Velma

Latest posts by Velma (see all)

- Does getting married change my credit score? - December 1

- What’s NOT considered in your FICO score - November 30

- What is a FICO score? - November 30